March

2015

N.J. District Court Applies Equitable Tolling to Deny Dismissal of Insured’s Complaint

On February 3, 2015, the United States District Court for the District of New Jersey denied an insurer’s motion to dismiss based on the one year suit limitation provision in the subject policy period on the grounds that the equitable tolling doctrine allowed the insured to bring suit more than a year after his property loss. Richard Inacio v. State Farm Fire and Casualty Co., (D. N.J. Feb. 3, 2015).

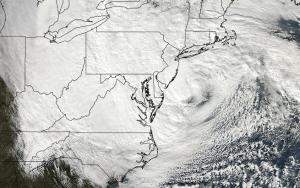

On June 13, 2014, plaintiff, Richard Inacio (“Plaintiff”) initiated a lawsuit against his insurer, State Farm Fire and Casualty Company (“State Farm”), seeking to recover under a homeowners insurance policy for wind and rain damage caused by Superstorm Sandy. State Farm moved to dismiss the complaint on grounds that Plaintiff’s action was barred by the policy’s one year suit limitation provision. Plaintiff countered that the equitable tolling doctrine allowed him to bring his suit more than one year after his property loss because State Farm did not formally deny coverage until August 18, 2013, and that a prior letter of December 7, 2012 lacked any specific denial language.

In denying State Farm’s motion to dismiss, the Court found that State Farm’s December 7 letter to Plaintiff, which only denied coverage for possible flood damage, failed to give any indication as to how much of the overall damage to Plaintiff’s dwelling and contents was caused by flood. Moreover, the court recognized that the letter made no reference to a payment of $901.29 that was previously paid to Plaintiff for wind and rain damage. Thus, the December 7 letter was not an “unambiguous denial” of Plaintiff’s claim for wind and rain damage. The Court further found that State Farm’s subsequent re-inspection of Plaintiff’s property in July 2013 and its subsequent payment of $15,005.37 on August 18, 2013, bolstered the Court’s conclusion that the December 7 letter was not an unambiguous denial.

Consequently, the Court held that State Farm did not issue a formal, unambiguous denial until the August 13 letter, which utilized “clear denial language” that was “wholly absent from the December 7 letter.” As a result, Plaintiff’s claims were not clearly barred by the suit limitations period and denied State Farm’s motion to dismiss.