November

2013

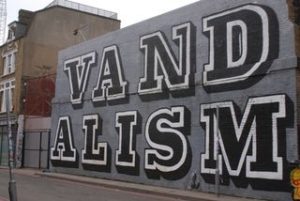

New York’s Highest Court Expands the Meaning of Vandalism in Property Policy

On certification from the Second Circuit Court of Appeals, New York’s highest court recently answered two questions of the first impression regarding the coverage afforded for vandalism under a “named perils” property policy. Georgitsi Realty, LLC v. Penn-Star Ins. Co., No. 156, 2013 NY Slip Op 06731 (N.Y. Oct. 17, 2013). The subject policy defined “vandalism” as willful and malicious damage to or destruction of covered property. The first question, which the Court answered in the affirmative, was: Whether malicious damage may be found to result from an act not directed specifically at the covered property? The second question was: If the answer to one is yes, what state of mind is required to establish malice? The Court answered that, in this context, malice requires the same state of mind necessary to obtain punitive damages – i.e. such a conscious and deliberate disregard of the interests of others that the conduct in question may be called willful or wanton.

The underlying coverage dispute in Georgitsi Realty, LLV stemmed from damage sustained by a four-story apartment building owned by the plaintiff/insured. The damage occurred when the owner of the lot next door endeavored to build a new structure with an underground parking garage. Specifically, the excavation work allegedly caused cracks in the walls and foundation of the plaintiff’s building, which ultimately worsened to a point where it was feared the building would collapse. The New York City Department of Buildings issued a series of violations and “stop work” orders, which were ignored. Plaintiff then obtained a temporary restraining order from the Supreme Court, which required the neighbor to cease construction. That order was likewise ignored.

Plaintiff made a claim under the aforementioned named perils property policy issued to the plaintiff by the defendant/insurer Penn-Star Insurance Company (“Penn-Star”). Penn-Star denied the claim and suit followed. The District Court for the Eastern District of New York granted summary judgment in favor of Penn-Star on the grounds that the alleged conduct was not “vandalism” within the meaning of the policy. Plaintiff appealed to the Second Circuit Court of Appeals, which certified the two questions set forth above to the New York Court of Appeals.

In answering the certified questions, the New York Court of Appeals Court explained:

We see no reason why the term “vandalism” should be limited to acts “directed specifically at the covered property.” Vandalism, as the term is ordinarily understood, need not imply a specific intent to accomplish any particular result; vandals may act simply out of a love of excitement, or an unfocused desire to do harm, or … as in the present case … or out of a desire to enrich oneself without caring about the consequences of others. Nor does it seem relevant that the alleged act of vandalism … did not bring the alleged vandals in direct contact with the covered property. Where damage naturally and foreseeably result from an act of vandalism, a vandalism clause in an insurance policy should cover it.

The Court went on to explain that in the context of property damages, it was adopting a definition of malice identical to the formulation it uses to review awards of punitive damages – i.e. whether the conduct reflects such a conscious and deliberate disregard of the interests of others that it may be called willful and wanton – which will serve to distinguish acts that may be fairly called vandalism from ordinary tortious conduct.

Justice Abdus-Salaam issued a written dissent, with respect to the second question, explaining that critically absent from the Court’s definition of malice was an intent to cause property damage. In his view, a perpetrator who acts maliciously but without the intent to damage property simply does not commit an act of vandalism. Thus, in the context of insurance coverage, the insured would have to establish that the vandal intended to damage or destroy property to obtain coverage, be it the property covered by the policy or otherwise.

For a copy of the Georgitsi decision and dissent click here