August

2012

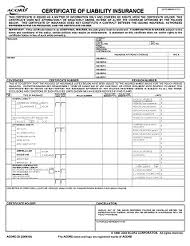

Virginia Passes Law Regulating Certificates of Insurance

Blogs, Cyber Risks, Liabilities, Insurance and Litigation

Virginia has amended its law to more closely regulate the issuance of certificates of insurance related to Virginia risks. Virginia Code section 38.2-518, which became effective July 1, 2012, prohibits any person from issuing a certificate of insurance containing any false or misleading information regarding the scope of the policy’s coverage. The amendment, which is codified within Virginia’s Unfair Practices law, applies to all producers, insurers, and certificate holders, as well as all certificates of insurance summarizing coverage on risks within the Commonwealth of Virginia. The new law states:

§ 38.2-518. Certificates of insurance.

A. As used in this section, “certificate of insurance” means a document, regardless of how titled or described, that is provided to a third party and is prepared or issued by an insurer or insurance producer as a statement or summary of an insured’s property or casualty insurance coverage. The term does not include any (i) policy of insurance, (ii) insurance binder, (iii) policy endorsement, (iv) automobile

identification card, (v) certificate issued under a group or master policy, or (vi) evidence of coverage provided to a lender in a lending transaction involving a mortgage, lien, deed of trust, or other security interest in or on any real or personal property.

B. No person shall issue or deliver any certificate of insurance that attempts to confer any rights upon a third party beyond what the referenced policy of insurance expressly provides.

C. No certificate of insurance may represent an insurer’s obligation to give notice of cancellation or nonrenewal to a third party unless the giving of such notice is required by the policy.

D. No person shall issue or deliver a certificate of insurance unless it contains a substantially similar statement to the following: “This certificate of insurance is issued as a matter of information only. It confers no rights upon the third party requesting the certificate beyond what the referenced policy of insurance expressly provides. This certificate of insurance does not extend, amend, or alter the coverage, terms, exclusions, or conditions afforded by the policy referenced in this certificate of insurance.” If a certificate of insurance is required by a state or federal agency and accurately reflects the coverage provided by the underlying policies, no such statement is required.

E. No person shall knowingly demand or require the issuance of a certificate of insurance from an insurer, insurance producer, or policyholder that contains any false or misleading information concerning the policy of insurance to which the certificate makes reference.

F. No person shall knowingly prepare or issue a certificate of insurance that contains any false or misleading information or that purports to affirmatively or negatively alter, amend, or extend the coverage provided by the policy of insurance to which the certificate makes reference.

G. The provisions of this section shall apply to all certificate holders, policyholders, insurers, insurance producers, and certificate of insurance forms issued as a statement or summary of insurance coverages on property, operations, or risks located in the Commonwealth.

Attorneys who deal with insurance issues are all too familiar with the situation where a certificate of insurance purports to represent a provision of coverage under a policy (such as a statement that a particular entity has been named as an additional insured, or that the policy in question provides coverage for completed operations). When litigation commences long after the certificate of insurance is accepted, and the policy itself is examined – lo and behold – whatever was listed on the certificate of insurance is found to be absent in the policy. Virginia now seeks to change that. Under the new law, nearly anyone – not only an insurance agent or insurer – may be subject to monetary penalties or professional sanctions for knowingly issuing a misleading certificate of insurance.

The provisions of Virginia Insurance law, including the recently-amended Virginia Code section 38.2-518, are enforceable by the Virginia Bureau of Insurance, which has wide latitude to enforce insurance issues.